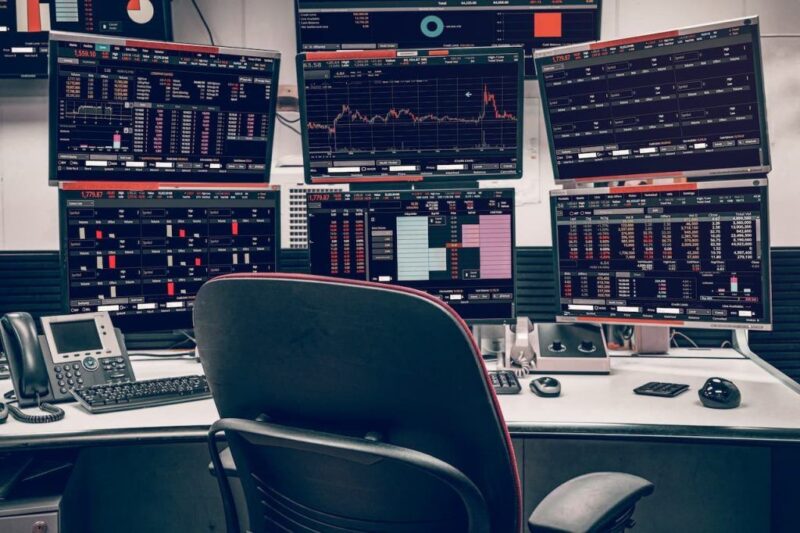

The world of day trading has always been fast-paced, demanding, and competitive. Success depends on having the right tools and resources. The landscape is constantly shifting, and traders need reliable solutions to help them stay ahead. Whether it’s data analysis, execution speed, or tracking trends, each decision made throughout the day is critical.

This article will cover some of the top tools and platforms that can help day traders gain an edge in 2024.

Key Points

- Fast and reliable platforms are essential for day traders.

- Risk management tools help protect traders from significant losses.

- Access to real-time market data is a must.

- Charting software provides critical insights.

- Mobile access to trades ensures flexibility.

1. Trading Platforms: Speed and Reliability

Day traders cannot afford delays. Execution speed often makes the difference between profit and loss. Platforms like MetaTrader 5, thinkorswim, and Interactive Brokers are well-known for offering excellent performance. However, an increasingly popular option for many traders is Binomo. The platform allows day traders to open positions with as little as $1, offering a low barrier to entry. With the Binomo login, traders can access their accounts on the go, manage trades, and take advantage of demo accounts to improve their skills before risking real money.

2. Charting Software: Visualizing Market Movements

A good charting tool is indispensable for day traders. It enables them to spot trends, identify breakout patterns, and set stop-loss levels. TradingView has long been considered the go-to charting platform for its user-friendly interface and extensive library of technical indicators. With real-time updates, it allows traders to visualize market movements effortlessly. Another option for more advanced charting is NinjaTrader, which offers customized analysis tools and strategy-building options.

In day trading, information is power. Charting software ensures that traders have all the necessary data to make informed decisions. Some traders also opt for multi-chart views, which provide simultaneous analysis of different markets.

3. Market News and Data Feeds

Having access to up-to-date news can make all the difference in trading. Bloomberg and Reuters continue to be the most trusted sources for financial news. Their live feeds provide traders with insights into market movements, policy changes, and global economic events. Fast access to reliable information enables day traders to make swift decisions based on news events.

Other real-time market data providers include Benzinga Pro and MarketWatch. Both offer a wealth of economic indicators, corporate news, and global reports, giving traders an edge when reacting to sudden market fluctuations.

4. Risk Management Tools: Protecting Your Capital

Day trading comes with risks, and protecting capital should always be a priority. Stop-loss orders and trailing stops are some of the most common tools used by traders to minimize losses. Platforms like MetaTrader offer these risk management options built directly into their interface. Another popular risk management tool is TradeStation, which allows for advanced order types such as conditional orders, which can execute or cancel based on specific criteria.

Risk management tools are critical for ensuring that no single trade can drastically reduce your capital. Traders can use these tools to automate parts of their strategy and protect themselves from volatile market swings.

5. Backtesting Software: Fine-Tuning Strategies

Backtesting is a method used by day traders to test their strategies using historical data. Software like Amibroker or MetaStock provides traders with the ability to simulate their trades in past market conditions. This approach helps traders assess the viability of a strategy before applying it in real-time markets.

Backtesting can save both time and money. By identifying the weak points of a strategy, traders can fine-tune their approach and avoid unnecessary losses. It’s a practical way to learn and adapt without facing real-world risks.

6. Economic Calendars: Tracking Key Events

Economic events such as interest rate decisions or employment reports can cause significant market movement. Economic calendars provided by platforms like Forex Factory or Investing.com are valuable tools for day traders. They allow traders to keep track of upcoming events and prepare for potential market volatility.

Economic calendars display critical data releases and their expected market impact. By keeping an eye on key economic dates, traders can avoid getting caught off-guard by sudden price shifts.

7. Trading Simulators: Practicing Without Risks

Trading simulators are essential for new and experienced traders alike. They allow users to practice in real market conditions without putting their capital at risk. The best simulators, such as those offered by NinjaTrader and MetaTrader, provide real-time market data, making the learning experience as realistic as possible.

Simulators provide a safe environment for traders to practice new strategies, refine their approach, and gain confidence in their trades. It’s a valuable resource for anyone looking to improve their performance before committing to live trading.

Conclusion

Day traders in 2024 have a wealth of tools and resources at their disposal. Success depends on access to reliable platforms, real-time data, risk management tools, and continuous learning. The tools listed above can help traders improve their strategies and stay competitive in the market. Whether it’s charting software or trading simulators, having the right tools can make all the difference.